Will we see a new floor? $30's?

Announcement

Collapse

No announcement yet.

And there was much rejoicing in the land.... Gas Prices

Collapse

X

-

More on that Iranian thing...

As Iran Vows To Double Oil Exports, Will The US "Swing Producer" Take The Hit?

The Wall Street Journal reported Monday that Iran plans to double its crude exports soon after sanctions are lifted. While much has to happen before this becomes reality, this news suggests roughly 500kbpd more Iranian barrels than the market has been expecting in a post-sanctions environment.

WTI prices are getting hammered, down almost 5% today on the news. Of course turmoil in Greece and Chinese markets isn't helping (it's a risk-off kind of day), but these Iranian barrels pose a significant threat to WTI prices. Interestingly, the Brent/WTI spread is widening by 200bps today - a sign the market may believe the US tight oil producers will be forced to take the hit.

A Deal That Would Lift Iran Sanctions Is Expected This Week

With pieces of a nuke deal that would lift sanctions falling into place over the weekend, a final accord is now widely expected this week. There are still significant hurdles (sanctions snapback mechanics and IAEA access), and any initial agreement could face pushback (both from direct parties like Congress and the Ayatollah as well as outsiders like Saudi Arabia and Israel). But Russia has said an Iran deal is >90% done, and the Rapidan Group, a political consultancy, puts the probability of an early-July deal at 70%.

Iran Exports Are Like A Pilot On A Runway

Iran’s deputy oil minister Mansour Moazami, said in an interview that his country’s oil exports would reach 2.3 million barrels a day, compared with around 1.2 million barrels a day today. “We are like a pilot on the runway ready to take off. This is how the whole country is right now,” he said.

The market has generally known a deal was coming, but big structural shifts like this are never priced in until they happen. Moreover, Moazami's comments imply a 1.1mmbpd injection from Iran into the global market, whereas analyst expectations have generally been that the country would add anywhere from 500kbpd to 700kbpd by sometime in 2016.

When it comes to ramping up exports, particularly in MENA, self proclamation is one thing and execution is another. It might take 6 months, 9 months, 12 months or years for Iran to make good on its promise. But one thing is clear: Iranian exports on the come are now a significant threat to the crude oil price equation for 2H15 and 2016 - particularly in the US - and it's time to brace for impact.

If The US Is The Swing Producer, Then This Is Devastating News For Shale Activity

If you believe (as many in the industry do) that the US is the swing producer (however unwilling) and US tight oil production must adjust to balance the global oil market, then these Iranian barrels are devastating. Effectively, the production ceiling on US independents just got lowered.

To understand why, we have to first understand the size of the swing production wedge in the US. Because of the extremely steep decline curves of unconventional oil wells, US unconventional oil production should be thought of in two categories:

- There is "legacy" production. This is not the swing factor. Legacy production is the sum of the "tails" of the tens of thousands of unconventional oil wells a year or two + on production. This production doesn't "swing" unless WTI prices fall below lifting costs ($20-$25/bbl). It is very steady and growing modestly as new wells roll in and offset the gradual natural decline.

- Then there is "new well" production. This is the swing factor. New well production is associated with wells drilled and completed in the past 12 months or so. This is what the industry can control - this is the swing factor that will fall with WTI prices. It is linked to capex, rigs, and jobs.

Typical Tight Oil Well - "New Well" Production For A Year And Then "Legacy" Production

In 2015, US unconventional oil plays will produce about 6.3mmbpd. Of this, about 3.9mmbpd is the "legacy" production and only 2.4mmbpd is the "new well" production per estimates from SunTrust Robinson Humphrey analysts. So the US swing production wedge (the amount that can fluctuate and theoretically balance the market) is 2.4mmbpd.

If Iran pushes an incremental 1.1mmbpd into the market next year... well, that's roughly half of what current US oil drilling activity is producing now - half the new well wedge. To us, this would suggest a big double dip is coming for WTI, along with further capex reductions, rig count reductions, and further job loss. We hate to be the bearer of bad news but when you start doing the push/pull math on 2016 oil fundamentals outlined below, it's just hard to see it any other way.

Recall that an imbalance of only around 2mmbpd (give or take a bit depending on whose estimates you use) caused the 50%+ oil price collapse of 2014. What do you think happens when commodity traders start doing the math above and realize that an incremental 2mmbpd imbalance may be looming in 2016?

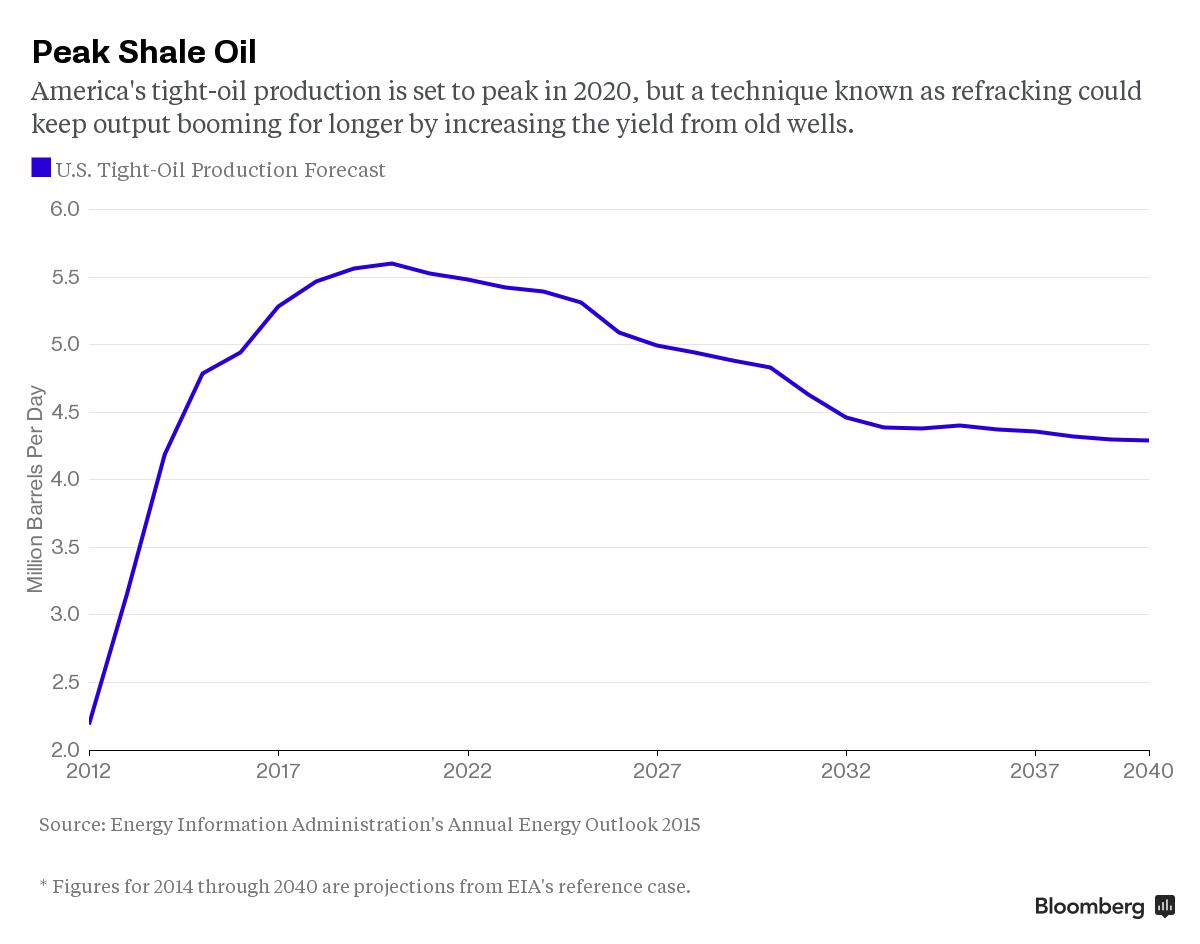

Absent an unforeseen saving grace for the industry (such as a Saudi position shift), we submit that oil prices have another big leg down coming. Whether in 2H15 or by early 2016, the coming correction could deliver the signal that will force the US to finally become a real swing producer. Although the EIA is forecasting a US production rollover, we are becoming increasingly skeptical of a material production decline absent another leg down in WTI price as many producers still intend to grow their new well production next year.

Comment

-

with such a large fraclog...im sure completions are still going to be needed. But a lot of field labor is being trimmed.Originally posted by Bputacoma View Post^ well that sucks. I was gonna apply for a well completion analyst job in fort worth too.

EDIT: The industry is still massively unstable however...and you will be competing with a lot of people fresh out of papa halliburton's completions department.

Comment

-

-

Getting slammed again today in just about every part of the market. Silver is down almost a dollar which doesn't make a lot of sense. I have seen speculation that some folks are getting margin called in China and are having to dump assets to cover. Unsure if that is true.Originally posted by racrguyWhat's your beef with NPR, because their listeners are typically more informed than others?Originally posted by racrguyVoting is a constitutional right, overthrowing the government isn't.

Comment

-

WTI almost went sub-50 today.Originally posted by Broncojohnny View PostGetting slammed again today in just about every part of the market. Silver is down almost a dollar which doesn't make a lot of sense. I have seen speculation that some folks are getting margin called in China and are having to dump assets to cover. Unsure if that is true.

Unrelated: A jackup off Qatar buckled a leg today. They're saying it was a 'punch through' and not a design or mechanical issue (one leg sunk into the seabed further than expected when pre-loading and jacking the platform out of the water)

And an interesting article on refracking and how it could be the new "thing"

Refracking Is the New Fracking

The technique itself is nothing new. Oil crews across the world have been schooled on its simple principles for generations: Identify aging, low-output wells and hit them with a blast of sand and water to bolster the flow of crude. The idea originated somewhere in the plains of the American Midwest, back in the 1950s.

But as today’s engineers start applying the procedure to the horizontal wells that went up during the fracking boom that swept across U.S. shale fields over the past decade, something more powerful, more financially rewarding is happening.

The short life span of these wells, long thought to be perhaps the single biggest weakness of the shale industry, is being stretched out. Early evidence of the effects of restimulation suggests that the fields could actually contain enough reserves to last about 50 years, according to a calculation based on Wood Mackenzie Ltd and ITG Investment Research data.

If the word fracking has carved out a spot in the lexicon of Americans as the nation advances toward energy independence, then refracking, as roughnecks have begun calling it, could be next. And for an industry that has been hammered by the 50 percent drop in crude prices over the past year, the finding on the technique’s potential -- at a fraction of the cost of the initial well -- provides a much-needed sense of hope.

The risks abound -- from inadvertently siphoning oil from an adjacent well to ruining a whole reservoir -- and the sample size so far isn’t big enough to be conclusive, but oil giants like Marathon Oil Corp. and ConocoPhillips aren’t waiting to incorporate refracking into their shale operations.

The Octofrac

Mike Vincent, a well-completion engineer who teaches the technique to industry workers, said he’s been overwhelmed by the sudden interest in the class. He even had to abandon plans he had been making to spend a week fly-fishing in the Rocky Mountains over the summer. “I’m booked every week teaching refrack classes out to November,” said Vincent, who runs a Denver-based firm called Insight Consulting. “It’s amazing how much passion there is.”

Years of working on traditional wells have shown that they can be restimulated multiple times, Vincent said. In the industry’s lingo, a well that has been blasted five times is a “Cinco de Fraco.” Eight times gets you an “Octofrac.” When done right, the procedure not only boosts the flow of crude, but can also increase the estimate of reserves held in the well. Vincent said it’s common to see oil recovery climb 60 percent or more.

“I’ve seen a well get 10 fracs through the same perfs, and it appears that we’re adding reserves every time,” he said.

100,000 Wells

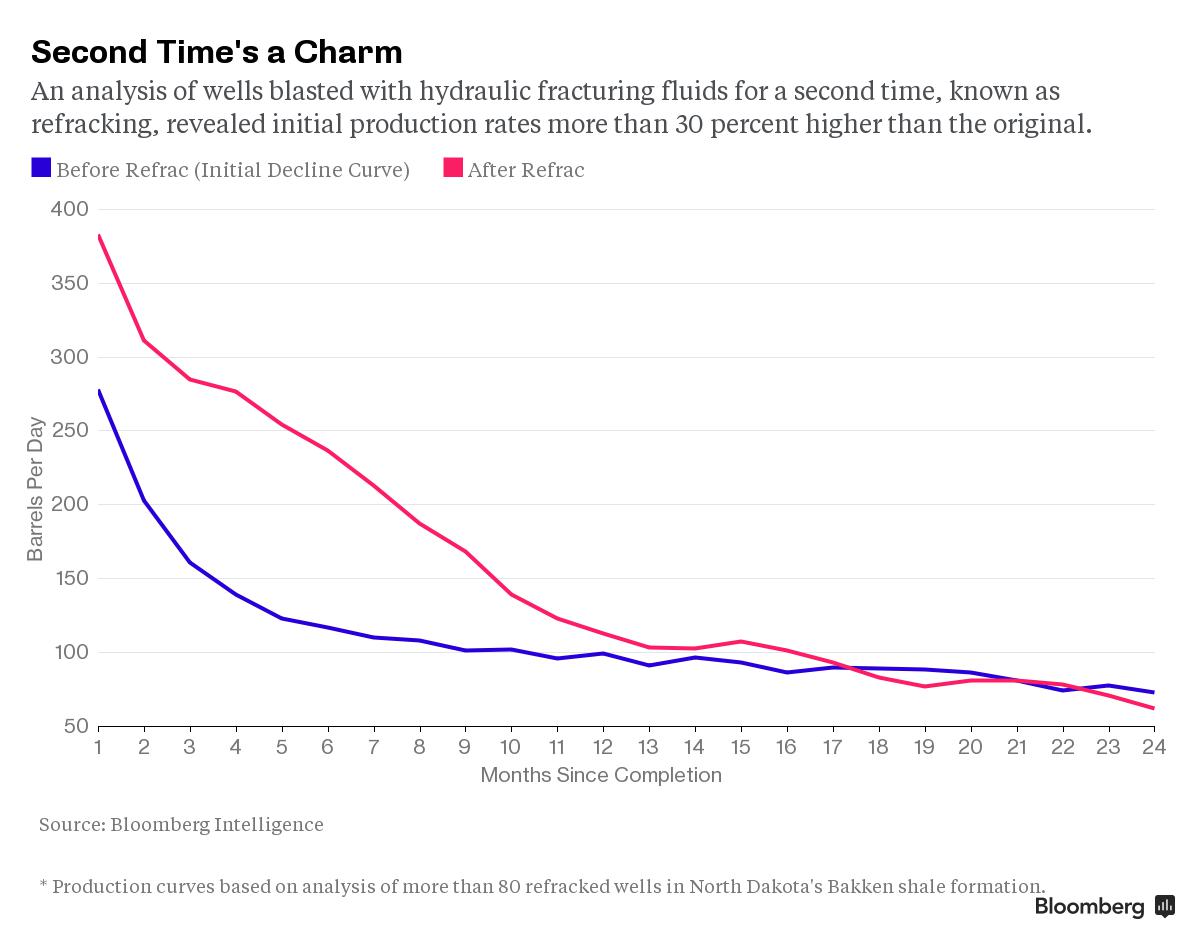

A study by Bloomberg Intelligence of about 80 wells that were originally tapped in North Dakota’s Bakken formation in 2008 or 2009 and then refracked again years later shows a clear pickup in output. The wells on average produced more than 30 percent more oil in the month after the refrack than they did after the original completion, according to analysts William Foiles and Peter Pulikkan.

While these kinds of increases are important to traditional drillers, they’re crucial in the shale industry, where output can start falling within days of a well being tapped. Companies such as EOG Resources Inc., the largest shale oil producer, have long acknowledged that they generally are recovering just a small fraction of the oil and gas in place in the biggest and most prolific reservoirs.

“We’ve seen big changes in completion technology, and it looks like that’s only going to continue,” said R.T. Dukes, an upstream analyst at Wood Mackenzie in Houston. He estimates that there are about 100,000 horizontal wells that could be restimulated. “At that point, it becomes significant.”

Many Risks

So far, a few hundred refracks of shale wells have been done in the U.S., a figure that Vincent predicts will grow to at least 3,000 over the next two years. And IHS Inc. forecasts they will come to make up as much as 11 percent of all hydraulic fracturing activity in the country by 2020.

The process to refrack a well isn’t that different than the original frac. Water, sand and other chemicals are pushed down the well, beyond the previously tapped areas, to create new fissures or to re-open clefts in the rocks that have closed.

It’s easy for things to go wrong. If poorly executed, the maneuver could take oil from the producing zones of other wells, or worse yet, ruin a reservoir. Then there’s the concern that some industry analysts have that a refrack only accelerates the flow without increasing the actual total output over the life of the well. EOG is among the drillers that remain reluctant to start using the procedure.

Refracking is still in its “early days,” said Robin Mann, global leader of the resource evaluation and advisory group in Deloitte LLP’s Houston office. “There’s always a risk you’re going to damage the reservoir or create interference between wells.”

‘Compelling Prize’

But in an industry that is desperately trying to cut expenses after oil fell below $60 a barrel from over $100 a year ago, the technique’s low cost has great appeal. Because the first step in the fracking process is already done -- the drilling of the wellbore -- the outlay is just a fraction of the $8 million or so it costs to tap a new well.

Sanchez Energy Corp., a Houston-based oil producer, expects to spend between $1 million to $1.5 million per well when it starts carrying out its first horizontal-well refracks later this year. The extra oil and gas it will pull out from each one as a result, meanwhile, could have a value, when measured in today’s dollars, of as much as $2.5 million, according to Chris Heinson, the company’s senior vice president and chief operating officer.

“It’s a compelling prize,” Heinson said in an interview last month. “There were a large number of wells out there that we know were originally completed with something that we could do better today. That’s really exciting.”

Comment

-

Come senators, congressmen

Please heed the call

Don't stand in the doorway

Don't block up the hall

For he that gets hurt

Will be he who has stalled

There's a battle outside ragin'

It'll soon shake your windows

And rattle your walls

For the times they are a-changin'

Oman goes solar for oil extraction

The sultanate of Oman aims to employ solar technology as a long-term method to extract its heavier grade of crude oil, a managing director said.

"The use of solar for oil recovery is a long-term solution," Raoul Restucci, managing director of Petroleum Development Oman, said in an interview published Wednesday by The Wall Street Journal.

The energy company along with its partners at Royal Dutch Shell and French energy company Total announced plans to install a 1,021 megawatt solar facility at the country's Amal West oil field for enhanced oil recovery.

Primary recovery from oil deposits relates to natural pressure in the reservoir. Secondary recovery involves water or gas injection into the well to increase production. Enhanced oil recovery techniques include further stimulation from steam, gas or chemical injections into the well.

Consultant group Wood Mackenzie finds that, for North American shale basins, enhanced oil recovery could result in a 100 percent increase in recovery rates and add between 1.5 million and 3 million barrels per day in oil production by 2030.

Oman is the largest regional oil and gas producer that's not a member of the Organization of Petroleum Exporting Countries. A 2013 report from the U.S. Energy Information Administration finds Oman produced 970,000 barrels of oil per day in 2000 and 710,000 bpd in 2007. Five years later, its production reached 919,000 bpd thanks in part to enhanced oil recovery techniques.

According to the Journal, Oman expects solar-driven enhanced oil recovery will be contributing to about 30 percent of its total production by 2023.

Shell U.S. unit name may drop ‘oil’ as alternatives proliferate

TORONTO (Bloomberg) -- The U.S. unit of Royal Dutch Shell Plc may soon drop the word “oil” from its name in a move that would signal its transition to other sources of energy, an executive said.

With Shell Oil Co.’s parent focusing more on natural gas and looking at other energy alternatives, the “oil” in the name “is a little old-fashioned, I’d say, and at one point we’ll probably do something about that,” Marvin Odum, director of the company’s upstream Americas business, said Thursday at the Toronto Global Forum.

“The increasing returns and the profile of some of the renewable-energy companies is absolutely true,” Odum said in an interview with Matthew Winkler, editor-in-chief emeritus of Bloomberg News. “The good news about that is it’s a clear signal that the transition is actually here.”

The Anglo-Dutch parent, Europe’s biggest oil company, began producing more natural gas than oil two years ago, a trend that has continued, Odum said. With the $70 billion acquisition of BG Group Plc, the company would become the world’s largest non-state gas producer.

Long article, highlights here

Why the Saudis Are Going Solar

The fate of one of the biggest fossil-fuel producers may now depend on its investment in renewable energy.

Near Riyadh, the government is preparing to build a commercial-scale solar-panel factory. On the Persian Gulf coast, another factory is about to begin producing large quantities of polysilicon, a material used to make solar cells. And next year, the two state-owned companies that control the energy sector—Saudi Aramco, the world’s biggest oil company, and the Saudi Electricity Company, the kingdom’s main power producer—plan to jointly break ground on about 10 solar projects around the country.

Most of Saudi Arabia’s power plants are colossally inefficient, as are its air conditioners, which consumed 70 percent of the kingdom’s electricity in 2013. Although the kingdom has just 30 million people, it is the world’s sixth-largest consumer of oil.

The Saudis burn about a quarter of the oil they prod uce—and their domestic consumption has been rising at an alarming 7 percent a year, nearly three times the rate of population growth. According to a widely read December 2011 report by Chatham House, a British think tank, if this trend continues, domestic consumption could eat into Saudi oil exports by 2021 and render the kingdom a net oil importer by 2038.

In October, the World Bank estimated that Saudi Arabia spends more than 10 percent of its GDP on these subsidies. That comes to about $80 billion a year—more than a third of the kingdom’s budget. “In my opinion, that’s an accurate number,” Nasser said. “This is not sustainable.”

Aramco is the most important player in the kingdom’s shift to solar power. The company’s initial forays have been tiny—a solar-panel array next to one of its office buildings, for example—but its plan to break ground on 10 or so bigger solar projects next year seems to represent the start of a more serious commitment. A high-ranking Saudi official told me he expects Saudi Arabia to develop an initial tranche of a few gigawatts of solar capacity over the next five years

Even at these cherry-picked sites, solar power is likely to cost more than electricity from the existing conventional plants—but only because those conventional plants get oil at a subsidized price. This explains why the government, not the private sector, is making most of the investment in solar

the goal Saudi Arabia announced three years ago of building 41 gigawatts of solar capacity remains a distant glimmer. In January, Saudi officials announced that they were pushing back the target date from 2032 to 2040—and even with the longer time frame, skeptics have dismissed the goal as a mirage.

Proving them wrong would require reshuffling an economic deck that the kingdom’s leaders have stacked for decades to favor petroleum. In that sense, Saudi Arabia’s energy challenge is a more extreme version of the one that faces the rest of the world. But if the kingdom’s leaders can find the political courage to act decisively, Saudi Arabia, of all nations, could become a model for other countries trying to shift away from oil.Last edited by Strychnine; 07-09-2015, 09:58 PM.

Comment

-

US rig count this week is -6 total.

Oil directed rigs -1, gas directed rigs +1

Also,

Schlumberger CEO Says The Downturn Is Behind Us In North America

Schlumberger kicked off oil earnings season with a bang Thursday afternoon. The company's 2Q earnings beat analyst expectations by more than 10%, and the company's CEO called the bottom for North America drilling activity (confirming the trough range we identified in late-May).

Here are four key points on the market outlook made by Schlumberger's CEO, Paal Kibsgaard in the earnings press release on Thursday.

1. Calling The North American Bottom. Schlumberger thinks the North American rig count is now touching the bottom, and CEO Kibsgaard sees a slow increase in land drilling and completion activity in the second half of the year. We called the bottom for US drilling activity during this phase of the downcycle on May 29, and the rig count is within 2% of its levels at that time. Our forward outlook differs a bit from Schlumberger that in that we believe a drilling increase in 2H15 would cause a self-induced double dip - US production needs to roll before rigs can go back to work sustainably.

2. Kibsgaard Is Not Worried About Iran. The CEO thinks that even with additional supply from Iran, the global supply-demand balance will tighten. He cited flattening North America production, weakening non-OPEC production internationally (especially in Brazil and Mexico) and the effects of softening investment levels together with strong demand as offsetting rising OPEC production. We are skeptical on this point, believe Iran barrels are worrisome, and see the back-of-the-napkin push/pull math for oil going into next year as challenging.

3. Forecasting The Spending Reduction. Schlumberger now sees E&Ps reducing spending in North America by 35% this year, and internationally reductions will total more than 15%. This is worse than what the company expected 3 months ago, where North America spending was expected to fall by more than 30% and international spending was to be down 15%.

4. More Brutal Than 2009. Schlumberger noted that the slow-down this downturn has been more brutal than in 2009. During the first half of 2015, Schlumberger's y/y revenue dropped 26% in North America and 14% internationally, more severe than in 2009. That said, the company's decremental margins are improved from 2009 - a sign the organization was better prepared for this downturn and is more efficient now. The chart in this post captures just how brutal this downturn has been compared to the precedents.

$1.5 Billion Of Cold Hard Cash Generated In 3 Months

Despite the tough industry conditions, Big Blue managed to generate an impressive $1.5 billion in free cash flow during the quarter. This level of cash flow is down only $160 million year-over-year, showing the power of the company's cash generation machine to weather the cycle.

Investors had been buying the stock ahead of earnings, as the "whisper" was a beat. These results look like they may be enough to keep the momentum going as the stock traded almost $2 higher in after hours trading when the release came out.

Comment

Comment