Originally posted by Strychnine

View Post

More of an update for Yale since he asked about market trends, but I'll leave it here. It's slowing down for a bit.

Summary

• The Q3 earnings season has largely confirmed and reaffirmed high‐level themes and industry trends that have been germinating and coalescing over

the preceding year. Yes, many of the discrete earnings results themselves were considerably worse than expected but the expected industry drivers

have played to form.

• What strikes us this earnings season is a growing willingness on the part of the domestic upstream industry to indeed strike the right balance

between and returns rather than relentlessly growth pressing the bet on unbridled growth. While the seeds of “balance” and “restraint” have only

recently begun to germinate, the gospel of “smarter” seems to be gaining on “faster,” while “realism” is encroaching on “optimism.”

• OXY, the largest liquids producer in the L‐48, delivered an especially eloquent treatise on the subject during its Q3 call. Basic message on the Q3 call was that the grand experiment of developing the NAM unconventional resource base isn’t working. Rate of exertion over the preceding two years is

proving to be unsustainable. While production growth has been commendable, cash flow generation and returns on capital employed have been far from satisfying. Accordingly, OXY is targeting significant cost savings in ‘13 and has significantly cut‐back on drilling activity.

• And while OXY may represent one of the more impassioned and credible voices with regard to improving its return profile, E&Ps are consistently

expressing a desire to augment cash flow generation, narrow funding gaps, become more balanced and generally strive to do more/the same with

less. For every CLR there now appears to be a growing number of companies reassessing business as usual.

• And this obviously has implications for the domestic oil service industry. Large cap service companies are, belatedly, beginning to “get it.”

Companies’ are striving to lower the capital intensity of the business, reexamining completion and business practices and generally taking a more

circumspect view with regard to the revived prospect of vibrant industry growth going forward.

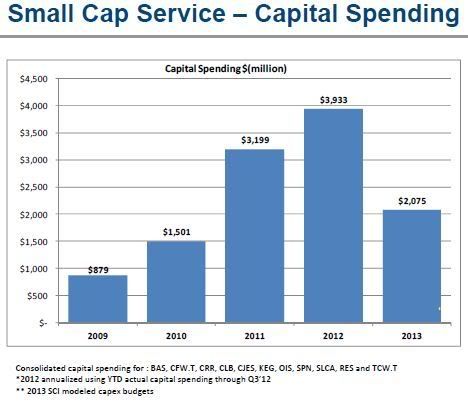

• Accordingly the rate of oil service capital investment will be significantly diminished in ‘13 and the prolonged period of industry deconsolidation

witnessed over the preceding years has now run its course.

• Further, at long last, management teams are beginning to at least profess a willingness to walk away from unacceptably low NAM service pricing.

This is a welcome conversion and a sensible one in response to today’s environment where growth looks to be more methodical and labored going

forward. Accordingly, a more balanced approach to capital spending and allocation on the part of the oil service industry is not only warranted, it is

long overdue.

• And it’s not all penance‐leads‐to‐virtue – simply contemplate the growth prospects and return profile of the Deepwater Complex (capital equipment, DW construction, offshore drillers)

• The Q3 earnings season has largely confirmed and reaffirmed high‐level themes and industry trends that have been germinating and coalescing over

the preceding year. Yes, many of the discrete earnings results themselves were considerably worse than expected but the expected industry drivers

have played to form.

• What strikes us this earnings season is a growing willingness on the part of the domestic upstream industry to indeed strike the right balance

between and returns rather than relentlessly growth pressing the bet on unbridled growth. While the seeds of “balance” and “restraint” have only

recently begun to germinate, the gospel of “smarter” seems to be gaining on “faster,” while “realism” is encroaching on “optimism.”

• OXY, the largest liquids producer in the L‐48, delivered an especially eloquent treatise on the subject during its Q3 call. Basic message on the Q3 call was that the grand experiment of developing the NAM unconventional resource base isn’t working. Rate of exertion over the preceding two years is

proving to be unsustainable. While production growth has been commendable, cash flow generation and returns on capital employed have been far from satisfying. Accordingly, OXY is targeting significant cost savings in ‘13 and has significantly cut‐back on drilling activity.

• And while OXY may represent one of the more impassioned and credible voices with regard to improving its return profile, E&Ps are consistently

expressing a desire to augment cash flow generation, narrow funding gaps, become more balanced and generally strive to do more/the same with

less. For every CLR there now appears to be a growing number of companies reassessing business as usual.

• And this obviously has implications for the domestic oil service industry. Large cap service companies are, belatedly, beginning to “get it.”

Companies’ are striving to lower the capital intensity of the business, reexamining completion and business practices and generally taking a more

circumspect view with regard to the revived prospect of vibrant industry growth going forward.

• Accordingly the rate of oil service capital investment will be significantly diminished in ‘13 and the prolonged period of industry deconsolidation

witnessed over the preceding years has now run its course.

• Further, at long last, management teams are beginning to at least profess a willingness to walk away from unacceptably low NAM service pricing.

This is a welcome conversion and a sensible one in response to today’s environment where growth looks to be more methodical and labored going

forward. Accordingly, a more balanced approach to capital spending and allocation on the part of the oil service industry is not only warranted, it is

long overdue.

• And it’s not all penance‐leads‐to‐virtue – simply contemplate the growth prospects and return profile of the Deepwater Complex (capital equipment, DW construction, offshore drillers)

Land Driller Assumptions

The following table represents our rig count and cash margin assumptions. All of the land drillers have newbuilds on order, but most of the drilling companies see an overall flattish-to-lower rig count from here.

The central question will be whether or not these land drillers gain market share through their newbuild programs or do they see existing rigs get laid down. Our models generally ties the company rig counts to our overall rig count forecast, thus upside is possible if the newbuilds do in fact add to market share.

That said, pricing is under pressure and with ~100 newbuilds still to be delivered, that could exacerbate the pricing pressures in a flattish rig environment.

The following table represents our rig count and cash margin assumptions. All of the land drillers have newbuilds on order, but most of the drilling companies see an overall flattish-to-lower rig count from here.

The central question will be whether or not these land drillers gain market share through their newbuild programs or do they see existing rigs get laid down. Our models generally ties the company rig counts to our overall rig count forecast, thus upside is possible if the newbuilds do in fact add to market share.

That said, pricing is under pressure and with ~100 newbuilds still to be delivered, that could exacerbate the pricing pressures in a flattish rig environment.

BAS - Basic Energy Services

CFW - Cano Petroluem

CLB - Core Laboratories

CJES - C&J Energy Services

KEG - Key Energy Services

OIS - Oil States International

SPN - Superior Energy Services

TCW - Trican Well Services

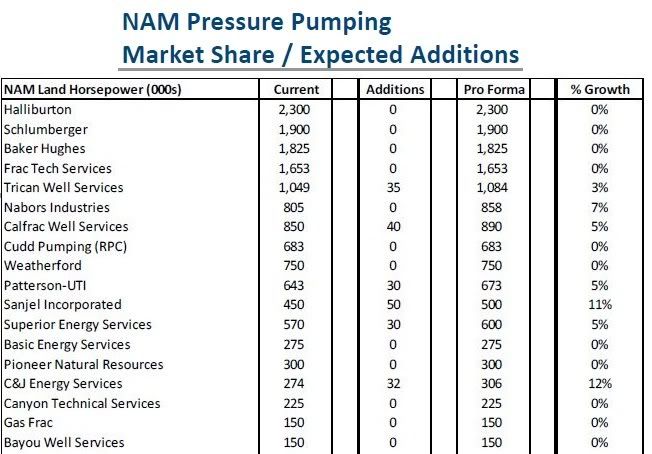

Lots of zeroes in the growth column on this chart (frac)

North America Pressure Pumping Market Share / Expected Additions

** We first began tracking North American frac horsepower in early 2010 at which time there were approximately ~20 frac companies.

** With the transition to horizontal drilling and the corresponding rise in service intensity, the frac boom began by mid‐2010 and it was clear that the industry did not have sufficient horsepower.

** Higher pricing and better utilization, as well as insatiable demand by E&P companies, fostered a frenzy of newbuild activity and today the market is oversupplied with equipment as we believe that there are at least ~50 frac companies today.

** The result is that pricing is in a free‐fall and margins are have compressed dramatically

** We first began tracking North American frac horsepower in early 2010 at which time there were approximately ~20 frac companies.

** With the transition to horizontal drilling and the corresponding rise in service intensity, the frac boom began by mid‐2010 and it was clear that the industry did not have sufficient horsepower.

** Higher pricing and better utilization, as well as insatiable demand by E&P companies, fostered a frenzy of newbuild activity and today the market is oversupplied with equipment as we believe that there are at least ~50 frac companies today.

** The result is that pricing is in a free‐fall and margins are have compressed dramatically

But at the end of the day, the O&G market is a roller coaster. IEA's 2012 executive summary (looking longer term) still says this:

Energy developments in the United States are profound and their effect will be felt well beyond North America – and the energy sector.

Leave a comment: