Originally posted by SS Junk

View Post

Announcement

Collapse

No announcement yet.

US may soon become world's top oil producer

Collapse

X

-

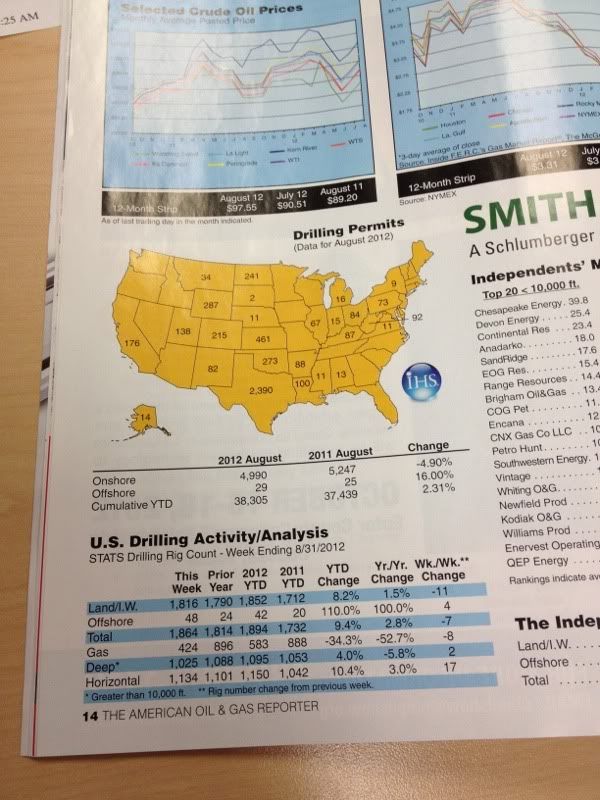

Just FYI, here's Baker's August rig count. I left the latest one in my car and I'm too lazy to go get it.Originally posted by Sean88gt View PostAny predictions on the next bust?

Check out that year to year delta on gas...

Leave a comment:

-

Who fucking knows, lol. CMI is cutting AOP for 2013 based on global economic fears and we have had a lot of QSK50 cancellations this year because of a slowing frac trailer build schedule Q3/4 this yr and into next, but then this came from one of our drilling customers today:Originally posted by Sean88gt View PostAny predictions on the next bust?

And I know another big driller in the US is building 24 new rigs next year.(i) ***** mgmt continues to believe that newbuild opportunities will exist in 2013;

(ii) ***** signed long term contracts for two newbuild service rigs;

(iii) ***** deployed 11 newbuilds in Q3 and

(iv) ***** is increasing its 2012 capex budget from $875mm to $921mm which reflects additional rig upgrade contracts and the two new service contracts.

The workover market is going strong too. There are multiple OEMs bidding on a ~20 rig contract for CA bound Nabors rigs right now... and thats's just one operator in one state.

NatGas is the next big thing in the oilfield. Not getting it out of the ground but powering the equipment. Within the next couple years you'll see more dual fuel (diesel / NG) driiling and frac rigs than you can imagine and you'll even start seeing pure NG (spark ignited) powered workover rigs.

Leave a comment:

-

As long as oil field workers keep getting hurt I'll still have a job.

Leave a comment:

-

Yes, we are a powerhouse. THE powerhouse. China has (at one time, I'm not current on these facts) the largest standing army, we have the most powerful. The number of nukes one has isn't the sole determining factor on an armies power, do some research into the state of the Russian military.Originally posted by 89gt-stanger View PostNot the entire supply. Yes, current monetary policy is a failure. If we have the same amount of nukes as Russia, I would not consider us a "powerhouse".

Leave a comment:

-

Not the entire supply. Yes, current monetary policy is a failure. If we have the same amount of nukes as Russia, I would not consider us a "powerhouse".Originally posted by Yale View PostIf you limit exports of oil, you'll collapse the market, so that won't work. Also, revenues in don't matter if your monetary policy is fundamentally flawed. Further, we already are the military powerhouse of the world. We can smash anything. Lastly, it's, "potato."

Leave a comment:

-

If you limit exports of oil, you'll collapse the market, so that won't work. Also, revenues in don't matter if your monetary policy is fundamentally flawed. Further, we already are the military powerhouse of the world. We can smash anything. Lastly, it's, "potato."Originally posted by 89gt-stanger View PostAs wierd as this sounds, a good solution at this moment would be a government program for oil drilling. They should have contracts with oil companies that impose restrictions on shipping oil out of north america. In return, they can drill on as much available public land as they want. That will flood our supply and drop the price at the pump like a hot potatoe. We would not have enough population to even fill all of the jobs. Then, we would also have all the funding we need to pay down the debt, strengthen our military and become the economic and military powerhouse of the world.

Leave a comment:

-

I think there was some good points though. We are seeing the prices drop & they saying below $3.00 in the near future & if we keep making cars like the new motor for the Vette coming out that does 30mpg. We might be able to leave another few generations the enjoyment of driving & enjoying the road. Cause one thing is sure. This nation & all other nations are oil dependant & it will always be a problem. But if we can stay on the path to making it stretch in Amercias future vehicles we will be able to leave a better future to our children & grandchildren

Leave a comment:

-

As wierd as this sounds, a good solution at this moment would be a government program for oil drilling. They should have contracts with oil companies that impose restrictions on shipping oil out of north america. In return, they can drill on as much available public land as they want. That will flood our supply and drop the price at the pump like a hot potatoe. We would not have enough population to even fill all of the jobs. Then, we would also have all the funding we need to pay down the debt, strengthen our military and become the economic and military powerhouse of the world.

Leave a comment:

-

No, we need to tax the oil companies more. If they have all this extra money to do this new drilling and exploration, they can chip in their fair share too.

Leave a comment:

-

Hopefully sooner than later. I'm ready for some mid $1 gas prices again.

Leave a comment:

Leave a comment: