Originally posted by Strychnine

View Post

Announcement

Collapse

No announcement yet.

And there was much rejoicing in the land.... Gas Prices

Collapse

X

-

Here's another take on it:Originally posted by broke again View Posti believe that the model is correct and crude is not prime driver. however if the price increases per barrel as opposed to decreases the price at the pump instantly reflects this increase. absolutely no lag time.....

This refiner's margin embodies two main elements -- operating cost and profit. For practical purposes, the operating cost element can be considered to be essentially constant since the cost of the raw material, crude oil, has already been deducted. Quantitatively this operating cost is on the order of 10-15¢/gal, shown as a solid horizontal line on the chart. The difference between this 15¢ and the value represented by the line, the wholesale margin, is the refiner's profit.

Two facts are immediately obvious. 1) No constant relationship, or even a pattern, exists between the refiner's cost and his selling price. It appears to be random. Some of the spikes are identifiable, such as hurricane timing, but some are essentially random in nature. 2) The refining profit portion of the margin appears to be dramatically excessive for long periods of time. If a 10-20¢/gal margin is a reasonable level, how can the industry justify profit levels of 50-75¢/gal which occurred numerous times for months on end? I suspect that if a CEO appeared before a congressional committee and the questioner knew enough to ask incisive and probing questions, the CEO would end up with the proverbial egg on his face.

The end of the line on the right hand side of the chart represents today's numbers. Refiners have recently been charging prices that result in margins of 60-70¢/gal, which produces profits of 45-60¢/gal -- pure profit. That number is more than $20/B, or half of some producers' total selling price for their production. Does something seem amiss?

Comment

-

Latest estimate ive seen (2 months ago) is 150,000+ globally.Originally posted by zachary View PostWith layoffs continuing to happen, do you know the number or have a chart about current lost jobs in the industry?

Comment

-

I read this on YB, kind of makes sense. Seriouslquestion, is there an idea of when we will RUN OUT of oil?Historically, if you graph the oil price through from the 1870, from the increase in internal combustion engines, though the first World war, through the depression, through WWII, through the increase in plastic and other petrochemicals, Suez, Iran, Kuwait, then the financial crisis in Asian, then in North America, etc etc.... and average it all out, oil should be around $36. Fact.

Comment

-

Nope...before the fracking boom, people thought they knew...but were not even close right now.Originally posted by Tremor14 View PostI read this on YB, kind of makes sense. Seriouslquestion, is there an idea of when we will RUN OUT of oil?

And with all the alternative energies that sprung from high prices and "global warming", its of little concern.

Comment

-

Some schools of thought think it replenishes. While the ability to get oil is ever increasing.Originally posted by Tremor14 View PostI read this on YB, kind of makes sense. Seriouslquestion, is there an idea of when we will RUN OUT of oil?

The Deepwater Horizon is just over 35,000' deep, the core is roughly 4,000 MILES deep (21 million feet deep). I'm not sure how deep seismic testing runs, but I'm sure there is more oil on this rock than we can understand at this point.

Comment

-

It replenishes, but not at the rate we're pulling it out. Matt posted a great quote a while back from a Saudi oil minister that was something like, "eventually we'll have oil in the ground and no one will be going after it/we didn't leave the Stone Age because we ran out of rocks."Originally posted by Sean88gt View PostSome schools of thought think it replenishes. While the ability to get oil is ever increasing.

The Deepwater Horizon is just over 35,000' deep, the core is roughly 4,000 MILES deep (21 million feet deep). I'm not sure how deep seismic testing runs, but I'm sure there is more oil on this rock than we can understand at this point.ZOMBIE REAGAN FOR PRESIDENT 2016!!! heh

Comment

-

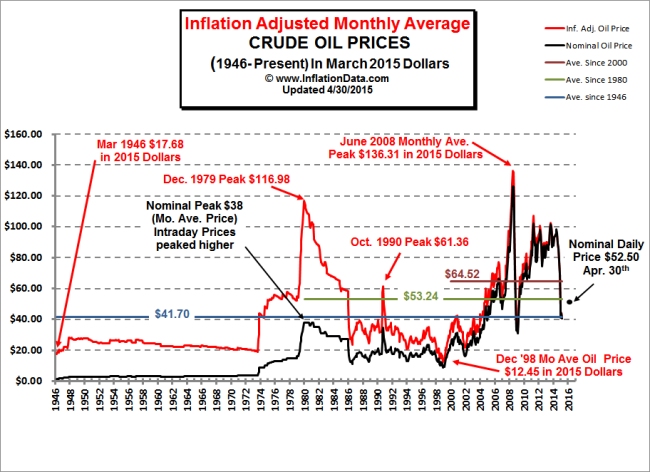

Yes, in real dollars (inflation adjusted) the average price of oil is about the same as what we're seeing right now.Originally posted by Tremor14 View PostI read this on YB, kind of makes sense. Seriouslquestion, is there an idea of when we will RUN OUT of oil?Historically, if you graph the oil price through from the 1870, from the increase in internal combustion engines, though the first World war, through the depression, through WWII, through the increase in plastic and other petrochemicals, Suez, Iran, Kuwait, then the financial crisis in Asian, then in North America, etc etc.... and average it all out, oil should be around $36. Fact.

But also look at the 15 year and 35 year averages - they are higher.

I had a midterm in "21st Century Global Energy Issues and Realities" over the weekend. Here's my 10 minute off-the-cuff answer the the peak oil topic:

I.1 Some people worry about running out of oil. Is that a serious concern? Discuss the relationship between available petroleum resources, price, and technology. What other primary energy resources could be used to replace petroleum and for what purpose(s)?

"Peak oil" is a concept that has been around since the mid 1950s, but it has been a semi-mainstream topic of conversation since the 1970s. Hubbert's theory was that the world would reach peak oil production in the by the early 1970s and after that our recoverable resources would continually diminish until the point that they were exhausted or too expensive to extract. No doubt, there must be a peak in production somewhere along the way; fossil fuels are not an infinite resource. It has been proven time and time again over the past decades though that with new technology in all parts of the petroleum industry we are quite able to push that peak event further and further into the future.

In the 1970s conventional drilling was the solution; vertical wells and pumpjacks. Legacy formations such as the Permian Basin in Texas, the San Joaquin Valley in California, and the Ghawar Field in Saudi Arabia were the sources du jour. Without innovation those fields would likely be pushed to their breaking points and incite some level of panic when they reached their absolute maximum production while global consumption was still climbing strongly. Along the way though we have seen incredible leaps in oil and gas technology; better reservoir mapping and other geologic tools have allowed the discovery of an ever growing number of fields around the world that were otherwise unknown. Just today Eni announced a new "super giant" gas field, stating, "Zohr is the largest gas discovery ever made in Egypt and in the Mediterranean Sea and could become one of the world’s largest natural-gas finds." (1) The peak oil timeline prediction did not account for such discoveries. Not only that, but even within existing fields, operators are now able to deploy new extraction techniques. When George Mitchell began using hydraulic fracturing efficiently and commercialized it and sold to Devon Energy it was the beginning of an energy revolution in North America. The fracturing, combined with horizontal drilling into shale plays, unlocked a treasure chest of resources. Natural gas production became so easy in the United States that many producers ended up working themselves our of jobs as they were creating much more product than the market even needed.

Along the way we will eventually need to replace petroleum products as our primary fuel source. Coal seems to be on the way out due to environmental and regulatory concerns, but nuclear is still a very strong and viable option. There are also many solar and wind concepts that have the potential to displace petroleum as well, if the energy storage aspect can be worked out. The catch here is that as oil prices rise people tend to look into those alternative sources, but when a new piece of oil and gas technology or a new find end up flooding the market with fossil fuels the price of oil drops and the incentive to invest in those alternatives is taken away, at least temporarily. As the moving average of petroleum products slowly rises over the next years and decades we will continue to see more investment and innovation in the alternative energy sector, but for the time being the oil and gas industry and their research and development dollars will continue to keep peak oil at bay and maintain the status quo.

1. http://www.egyptoil-gas.com/news/eni...-mediterranean

Ehhhhhh... you sure about that?Originally posted by DennyYep. Oil is both biotic and abiotic.

Abiogenic Origin of Hydrocarbons: An Historical Overview

Geoffrey P. Glasby

Laboratory for Earthquake Chemistry, Graduate School of Science, University of Tokyo, 7-3-1 Hongo, Tokyo 113-0033,

Japan

[e-mail: g.p.glasby@talk21.com]

Contact address: 42, Warminster Crescent, Sheffield S8 9NW, U.K.

Received on October 6, 2005; accepted on October 26, 2005

Abstract

The two theories of abiogenic formation of hydrocarbons, the Russian-Ukrainian theory of deep, abiotic petroleum origins and Thomas Gold's deep gas theory, have been considered in some detail. Whilst the Russian-Ukrainian theory was portrayed as being scientifically rigorous in contrast to the biogenic theory which was thought to be littered with invalid assumptions, this applies only to the formation of the higher hydrocarbons from methane in the upper mantle. In most other aspects, in particular the influence of the oxidation state of the mantle on the abundance of methane, this rigour is lacking especially when judged against modern criteria as opposed to the level of understanding in the 1950s to 1980s when this theory was at its peak. Thomas Gold's theory involves degassing of methane from the mantle and the formation of higher hydrocarbons from methane in the upper layers of the Earth's crust. However, formation of higher hydrocarbons in the upper layers of the Earth's crust occurs only as a result of Fischer-Tropsch-type reactions in the presence of hydrogen gas but is otherwise not possible on thermodynamic grounds. This theory is therefore invalid. Both theories have been overtaken by the increasingly sophisticated understanding of the modes of formation of hydrocarbon deposits in nature.

Comment

-

continued from the same research, 14 pages later:

Summary

The preceding sections have outlined the two principal theories of abiogenic formation of petroleum hydrocarbons. The Russian-Ukrainian theory of deep, abiotic petroleum origins was an attempt to formulate a scientifically rigorous theory of hydrocarbon formation which could play a major role in the exploration and exploitation of hydrocarbon deposits in the Soviet Union in the immediate post-war period. The theory is rigorous in its interpretation of the thermodynamic data for the conversion of methane to higher hydrocarbons at high temperatures and pressures. However, the formation of higher hydrocarbons from methane is only one step in the complex chain leading to the formation of commercial petroleum deposits and there are several major objections to this theory. First and foremost is the fact that the mantle is too oxidizing for methane to form there in abundance. Furthermore, most volatiles including methane are transported from the mantle to the Earth’s crust in magma and not by faults as required by the theory. The occurrence of major oil and gas fields in crystalline basement rocks was also taken as confirmation of the abiogenic theory. However, this assumption predates modern theories of fluid migration in the Earth's crust. The theory also identified a number of mechanisms by which higher hydrocarbons can be formed abiogenically, of which serpentinization of ultramafic rocks does have

the potential to produce commercial oil and gas fields.

Proponents of the abiogenic theory have also emphasized perceived inadequacies of the biogenic theory for the formation of petroleum hydrocarbons. However, at the time that the abiogenic theory was at its peak from the 1950s to the 1980s, it was not possible to assess the relative merits of these two theories objectively on the basis of the then existing scientific data and this only became possible with the development of much more sophisticated techniques for the analysis of the organic constituents in petroleum such as GC/MS in the 1980s. As a result, a much more detailed understanding of the pathways of organic constituents from source rocks to petroleum was established which offered convincing evidence to support the biogenic theory. By contrast, the abiogenic theory made no real attempt to explain the formation of the very complex mixture of organic compounds which make up oil.

A major claim of the Russian-Ukrainian theory of abiogenic hydrocarbon formation is that it had major successes in the discovery of oil and gas deposits in crystalline basement rocks. However, it now appears that the great oil fields of the Volga-Urals region, the northern Urals and western Siberia were discovered not as a result of application of this theory as its proponents claim but by the use of conventional exploration methods which gave “the final word to the borehole”. Furthermore, recent studies of the petroleum resources of the Dnieper-Donets Basin in the Ukraine by the U.S. Geological Survey have been interpreted entirely within the framework of conventional petroleum geology with no mention made of an abiogenic source of hydrocarbons. These failures of the Russian-Ukrainian theory in areas where it has claimed its greatest successes essentially bring its role as a viable theory on which to base exploration programmes for commercial hydrocarbon deposits to an end. As a matter of fact, this theory is now largely forgotten even in the Former Soviet Union and virtually unknown in the west.

The deep gas theory of Thomas Gold is based on the assumption that deep faults play the dominant role in the continuous migration of methane and other gases to the Earth's surface and that this methane is then converted into oil and gas in the upper layers of the Earth’s crust. However, this reaction is not thermodynamically favourable under these conditions and can not be facilitated by the presence of bacteria. In addition, deep drilling of the Siljan Ring did not offer any convincing evidence for a dominant mantle source for hydrocarbon

formation there. This theory is therefore invalid

Comment

Comment