Originally posted by chronical

View Post

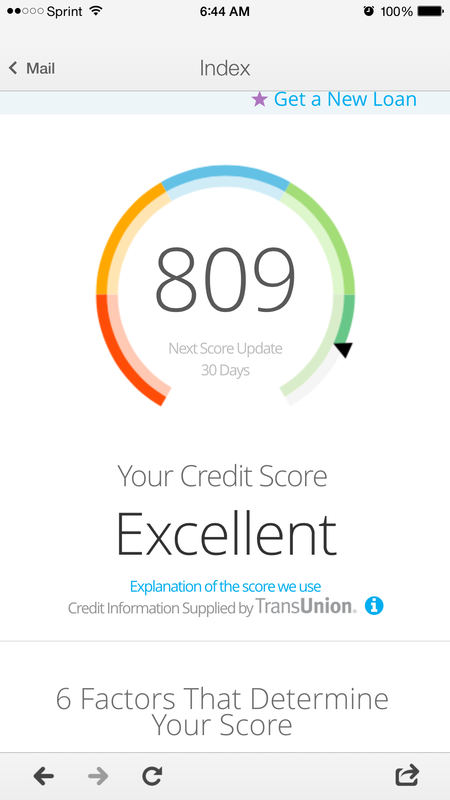

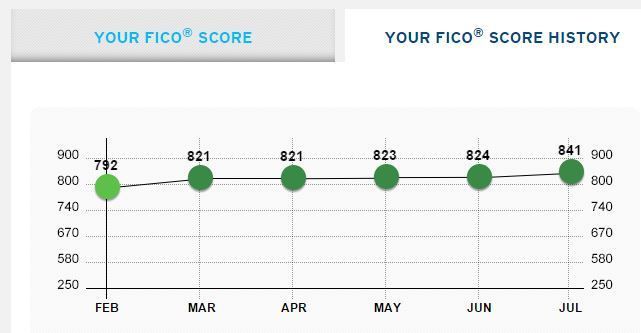

My system obviously works for me since I'm in the 800s so I see no reason to change. I just have all my cards on autopay and they come out of my account on the due date

Leave a comment: